Cut the Clutter: The Best 7 Invoice Apps for Busy Contractors

As a contractor, you know that getting the job done right is only half the battle—the other half is ensuring you get paid promptly and properly. That’s where the right invoicing app can make all the difference. With features designed specifically for the needs of contractors, the top invoice apps can help you keep a steady cash flow, maintain detailed records, and eliminate billing errors that can cost you time and money. Ready to cut the clutter and to take control of your finances with efficiency and ease?

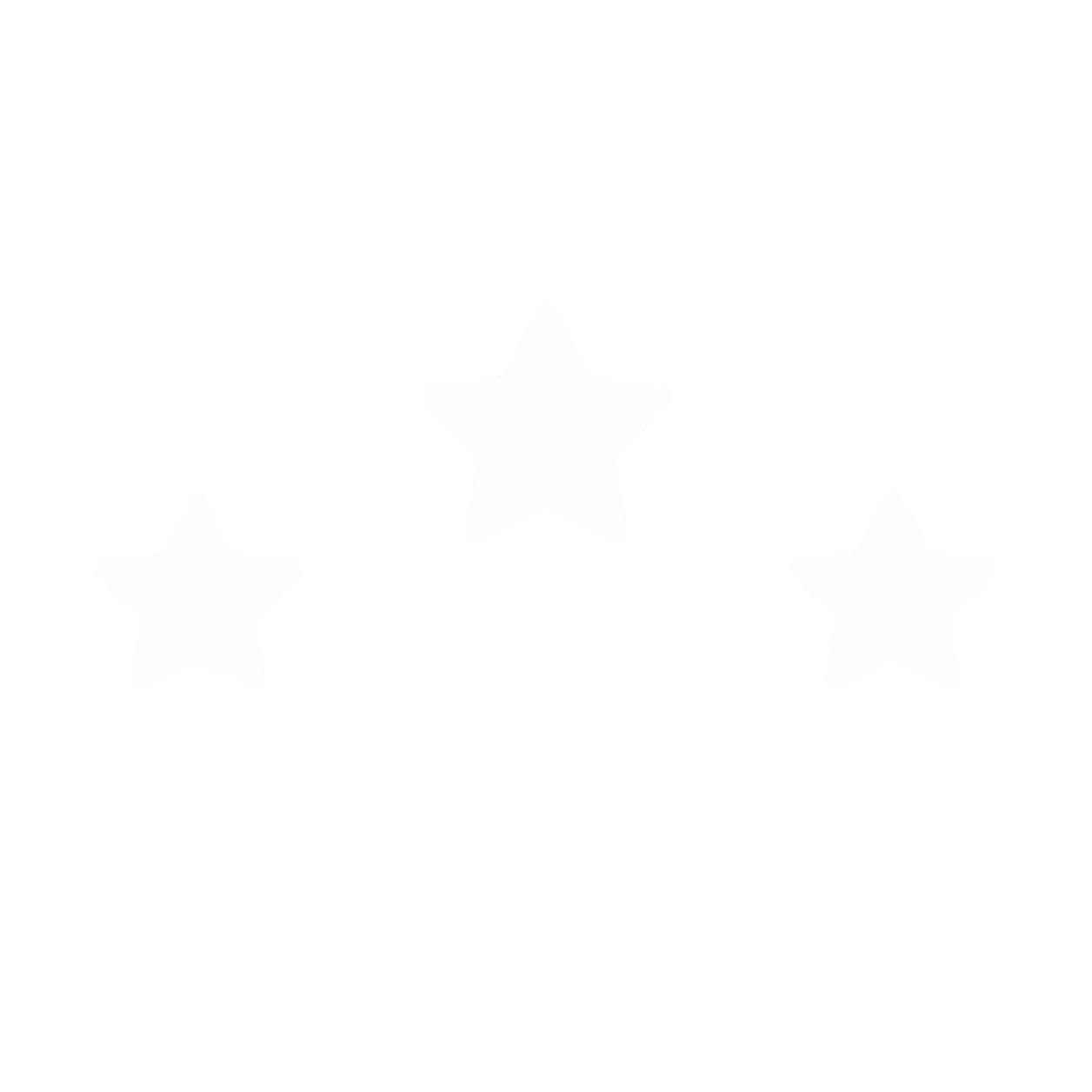

FreshBooks

FreshBooks is a cloud-based accounting software designed primarily for small businesses, freelancers, and independent contractors. It provides robust tools to manage finances, including invoicing, expense tracking, and time management, aiming to streamline operations for its users.

Key Features:

- Invoicing: FreshBooks offers advanced invoicing features such as automatic payment reminders, customizable invoices, multi-currency and multi-language support, and the ability to accept credit card payments directly on invoices.

- Expense Tracking: The app includes features to attach receipts, categorize expenses, and even track spending in multiple currencies, making it easier to manage finances and prepare for tax season.

- Time Tracking: Users can log hours, track time against specific clients or projects, and even use a timer to ensure accurate billing for hourly work. This feature integrates with project management tools via a Chrome extension.

- Project Management and Collaboration: FreshBooks allows users to invite employees, contractors, and clients to collaborate on projects, share files, and communicate directly within the platform.

- Automatic Financial Reports: The software can automatically generate detailed financial reports including profit and loss statements, helping businesses keep track of their financial health.

- Availability: It's available on both iOS and Android platforms, supporting a broad range of devices.

Advantages:

- User-Friendly Interface: Known for its clean and intuitive interface, FreshBooks makes it easy for non-accountants to manage their finances effectively.

- Strong Customer Support: FreshBooks provides excellent customer service, with multiple support options and resources available to users.

- Flexibility: The software is designed to accommodate a variety of business needs with features like recurring invoices, automated tax calculations, and customizable due dates for payments.

Disadvantages:

- Pricing Structure: While FreshBooks offers competitive pricing, the costs can add up as additional users are added or more advanced features are required.

- Client Limits: Some plans have limitations on the number of active clients you can bill, which might be restrictive for growing businesses.

Overall, FreshBooks is highly recommended for small business owners and contractors looking for a versatile and efficient way to manage their business finances. With its broad range of features and user-friendly design, it helps streamline the process of financial management, making it easier to focus on other aspects of business growth.

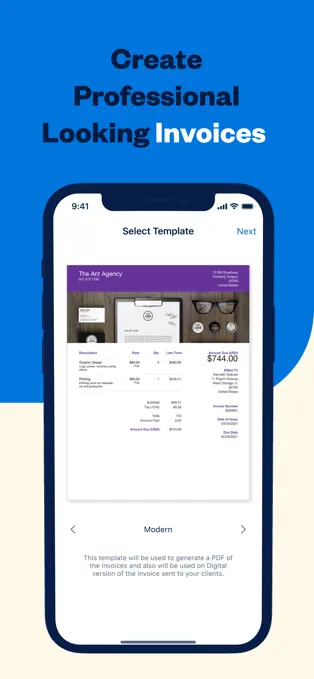

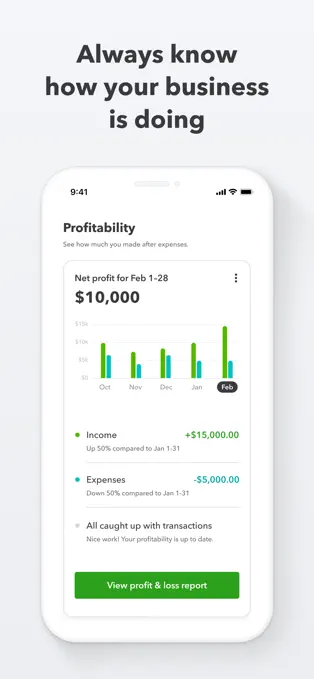

QuickBooks Accounting

QuickBooks Accounting caters to the financial management needs of small businesses, freelancers, and self-employed individuals. It offers a range of features that streamline accounting tasks and enhance financial oversight. It is particularly beneficial for those who require a mobile solution with strong integration and scalability options.

Key Features:

- Expense Tracking: QuickBooks Accounting automatically imports and categorizes bank and credit card transactions, making it easier to keep track of expenses. Users can snap photos of receipts to add them directly to their expense records.

- Invoicing and Estimates: The app allows users to create professional invoices and estimates from their mobile devices. Invoices can be customized with logos, payment terms, and more. Clients can accept and sign estimates directly on the user's device.

- Financial Reports: QuickBooks provides comprehensive financial reporting tools, enabling users to generate a variety of reports such as profit and loss statements, balance sheets, and more.

- Mileage Tracking: The app includes automatic mileage tracking to help users log every business trip accurately, which can be beneficial for tax deductions.

- Availability: The app is available on both iOS and Android platforms.

Advantages:

- Accessibility: QuickBooks Online, accessible via the app, allows users to manage their finances from anywhere, making it ideal for business owners who travel frequently or do not have a fixed office.

- Scalability: The cloud-based system supports up to 25 users, providing flexibility as businesses grow.

- Integration: It integrates well with numerous third-party applications, enhancing its functionality and usability.

Disadvantages:

- Cost: The app is free to download, but to use the most features you need a subscription, like many other cloud-based accounting solutions.

- Complexity: Some users find the interface and features more complex than those of other simpler applications, which may present a steep learning curve for new users.

Overall, QuickBooks Online offers robust capabilities tailored to meet the needs of diverse business operations, supporting everything from basic bookkeeping to complex financial management.

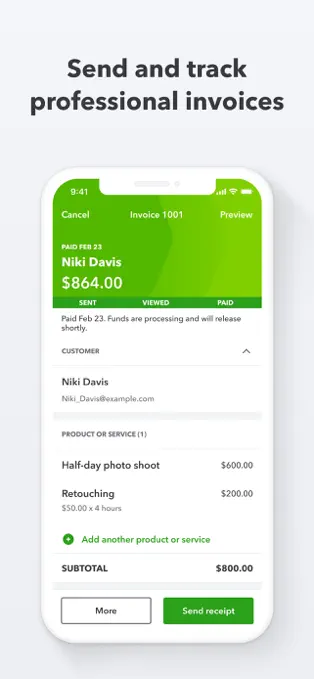

Square Invoices

Square Invoices is a mobile invoicing application designed for simplicity and efficiency, catering to small businesses, contractors, freelancers, and service providers who need to manage billing and payments smoothly.

Key Features:

- Comprehensive Invoicing Tools: Square Invoices allows users to create and send professional invoices and estimates quickly. The app supports multiple payment methods including credit card payments, ACH bank transfers, and mobile payments like Cash App Pay and Afterpay.

- Customizable Invoices: Users can customize invoices with their logo, color scheme, and include personalized messages. Invoices can also be scheduled as recurring for regular billing.

- Advanced Features: For more complex needs, Square offers features like multi-package estimates, milestone-based payment schedules, and the ability to save and reuse custom invoice templates. These are particularly useful for growing businesses looking to streamline their invoicing processes.

- Availability: It's available for both iOS and Android devices.

Advantages:

- Ease of Use: The app is praised for its straightforward interface, making it easy for users to manage invoices and payments effectively.

- Integration Capabilities: It integrates seamlessly with popular accounting software like QuickBooks Online and Xero, facilitating a smoother workflow for financial management.

Disadvantages:

- Transaction Fees: While the app itself is free, transaction fees apply when processing payments. These fees vary depending on the payment method and can be a consideration for businesses with high transaction volumes.

Overall, Square Invoices stands out for its comprehensive features that cater to a wide range of business needs, from basic invoicing to complex payment processing. Its flexibility, combined with strong customer support options like phone, email, and chat, makes it a robust choice for businesses looking to streamline their financial operations.

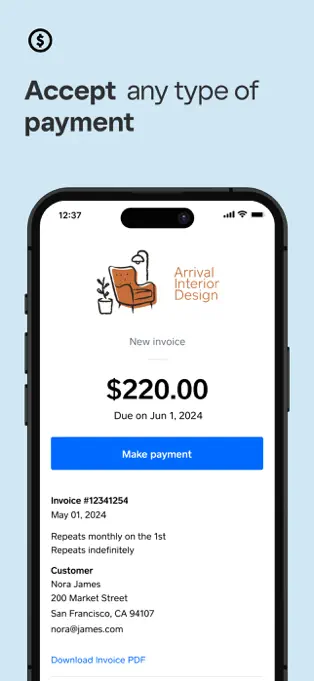

Invoice Simple: Receipt Maker

Invoice Simple: Receipt Maker is designed for creating and sending professional invoices, estimates, and receipts quickly and easily. Ideal for small business owners, freelancers, and contractors, this app simplifies the invoicing process and allows users to manage their billing directly from a mobile device.

Key Features:

- Professional Templates: Users can choose from a variety of invoice templates which they can customize with their logo, adding a professional touch to their transactions.

- Easy to Use: The app guides users through creating invoices, making it straightforward to add details such as client information, services or products, prices, and taxes.

- Online Payments: Invoice Simple supports online payments, allowing clients to pay via credit card, which can help speed up the payment process.

- Expense Tracking: The app includes an expense tracker that helps users manage and record business expenses, simplifying accounting tasks and tax preparation.

- Availability: It's available on both iOS and Android platforms, supporting a broad range of devices.

Advantages:

- Mobility: Invoices can be created and sent on the go, providing flexibility for mobile professionals.

- Customer Interaction: The app allows for immediate sending of invoices via email or text, which can enhance client communication.

- Customization Options: Users can personalize invoices and receipts to align with their brand identity, enhancing their professional image.

Disadvantages:

- Cost: While the app itself is free for basic functions, more advanced features require a subscription, which may be a consideration for budget-conscious users.

- Online Payment Fees: The fees associated with online payment options may accumulate, particularly for businesses handling larger transactions.

Overall, Invoice Simple: Receipt Maker is highly regarded for its user-friendly interface and functional design, making it a popular choice for individuals and small businesses looking to streamline their invoicing processes.

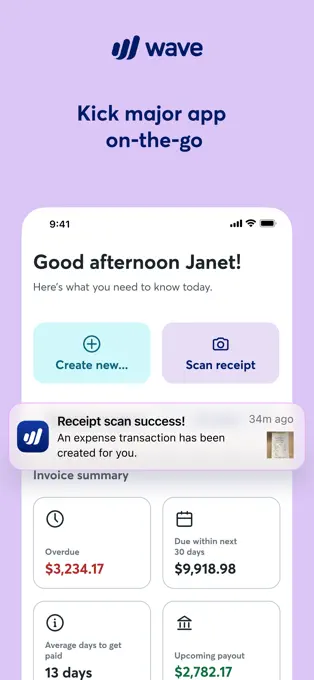

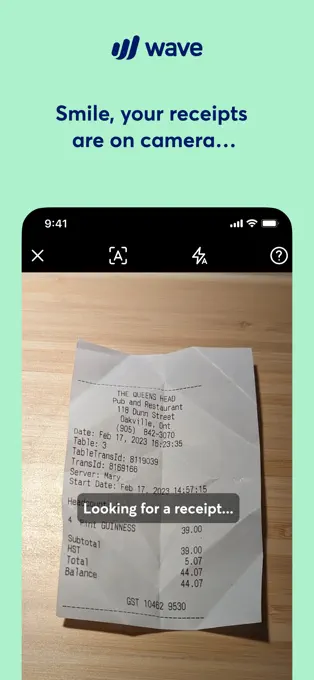

Wave: Small Business Software

Wave: Small Business Software is an all-encompassing financial solution tailored for small businesses, freelancers, and contractors. It integrates features for accounting, invoicing, payroll, and payments into a single, user-friendly platform.

Key Features:

- Comprehensive Accounting: Wave offers real double-entry accounting that includes income and expense tracking, customizable invoicing, and the ability to connect bank and credit card accounts for automated transaction imports.

- Invoicing and Payments: Users can create and send professional invoices easily, set up automatic payment reminders, and accept payments via credit card and bank transfers. Wave ensures fast processing, often within two business days in the US, and supports multiple currencies and VAT for international transactions.

- Payroll Services: The software includes options for payroll processing, with features tailored for both full-service and self-service setups, depending on the user's needs.

- Advisory Services: Wave provides access to a team of bookkeeping, accounting, and payroll experts to offer personalized advice and support, enhancing the overall user experience.

- Availability: The app is available on both iOS and Android platforms.

Advantages:

- No Cost for Basic Use: One of Wave's most significant advantages is that its core accounting features are available for free, which is particularly appealing for small businesses and startups.

- Ease of Use: The platform is designed to be intuitive and user-friendly, making it accessible even for those without prior accounting knowledge. Setup is straightforward, with helpful guides and a clean interface.

Disadvantages:

- Limited Integrations: Unlike some competitors, Wave does not offer extensive built-in integrations with other third-party apps. Users looking to connect Wave with other tools must often rely on Zapier for integration, which can be an additional cost.

- Customer Support Limitations: Support is primarily available via live chat or email, with more direct customer service options like phone support not available. Additionally, support availability may be limited to business hours.

Overall, Wave: Small Business Software is a robust choice for small businesses looking for a cost-effective solution to manage their financial processes comprehensively. It offers a range of features that are both powerful and easy to use, with the flexibility to support businesses as they grow.

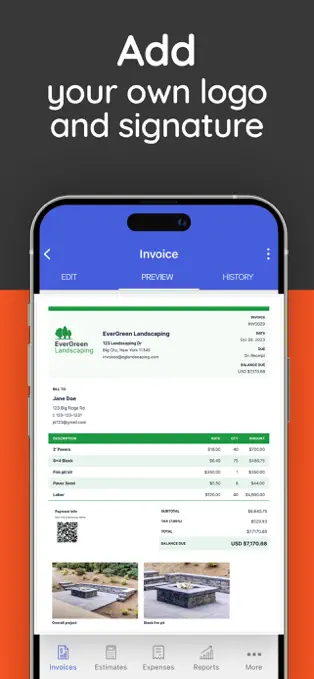

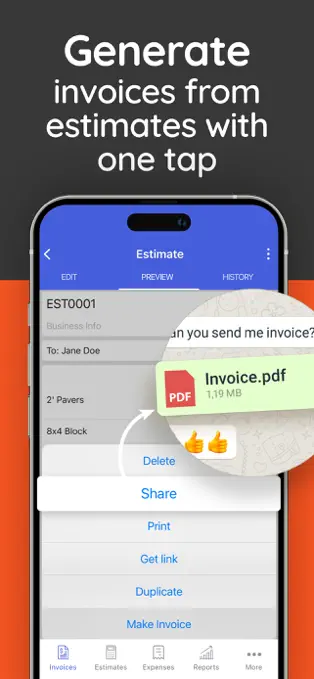

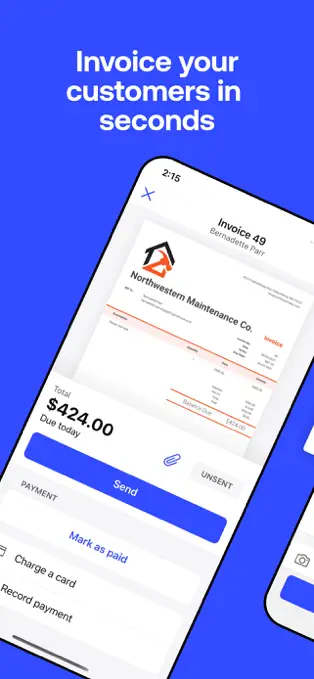

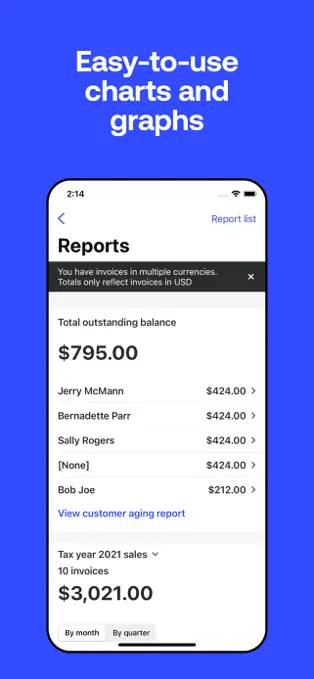

Invoice2go: Easy Invoice Make

Invoice2go is an invoicing software primarily for small business owners, freelancers, and contractors who need efficient tools to manage invoicing and payments on the go. It offers a variety of features that make creating and sending professional invoices quick and easy.

Key Features:

- Customizable Invoices: Users can create professional-looking invoices using customizable templates, which can be tailored with their company logo and color scheme.

- Payment Options: Invoice2go supports various payment methods including direct transfers, PayPal, and major credit cards like Visa, Mastercard, and American Express.

- Recurring Billing: For businesses with regular clients, Invoice2go offers the functionality to send recurring invoices and automatically charge repeat customers.

- Mobile Functionality: The app is optimized for mobile use, allowing users to manage invoices and payments directly from their iOS or Android devices.

Advantages:

- Ease of Use: The app is noted for its user-friendly interface, making it simple for users to create and manage invoices without needing extensive training.

- Efficiency: Features like automatic payment reminders and the ability to track when invoices are opened help businesses manage their cash flow more effectively.

Disadvantages:

- Limited Integrations: The basic plans offer limited integrations with third-party services, which might be a constraint for businesses looking for a more integrated solution.

- Cost Considerations: While Invoice2go provides a range of valuable features, the costs can add up, especially with transaction fees for payment processing which may not always be clear upfront.

Overall, Invoice2go is well-suited for small business operators looking for a straightforward, mobile-friendly invoicing solution. However, those needing more robust accounting features or integrations might find it necessary to look at other options or higher-tier plans within Invoice2go.

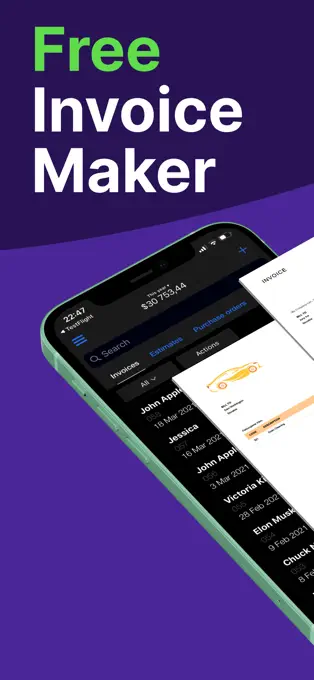

Easy Invoice Maker App

Easy Invoice Maker App is an app for small businesses, contractors and freelancers who need a straightforward solution for creating and managing invoices on the go. It is particularly praised for its simplicity and effectiveness in streamlining the invoicing process and it’s free to use.

Key Features:

- Invoice and Estimate Creation: Users can quickly generate professional invoices and estimates, customize them with details such as descriptions, prices, and taxes, and send them directly to clients.

- Client Management: The app allows for easy setup of client details directly from the user’s contact list, enhancing the speed and efficiency of invoice generation.

- Payment Tracking and Management: It includes features for tracking payments and managing overdue invoices, helping users maintain an up-to-date record of their finances.

- Mobile Functionality: With apps available for both iOS and Android, Easy Invoice Maker enables users to handle invoicing tasks directly from their smartphones.

Advantages:

- Cost-Effectiveness: The app is free to download and use, with all core features available without subscription. This makes it an economical choice for users who need basic invoicing capabilities without the additional cost.

- Ease of Use: The app is noted for its simple interface and ease of use, allowing even those who are not tech-savvy to navigate and manage invoices efficiently.

Disadvantages:

- Limited Customization and Features: While great for basic use, some users might find the features somewhat limited, especially if they require advanced invoicing functionalities such as extensive customizations or integrations with other business software.

Overall, the Easy Invoice Maker App offers a practical solution for those who need to manage invoices without the complexity of more comprehensive accounting software. Its straightforward design and cost-free model make it especially suitable for freelancers, contractors and small business owners looking for an efficient way to manage billing and payments.

With the capabilities to customize invoices, automate reminders, and even track payments in real-time, these apps empower you to focus more on the work you love and less on the paperwork you don’t. Whether you’re a solo electrician, a freelance designer, or the head of a construction team, an effective invoicing app can improve how you handle the financial aspects of your business. Don't let invoicing woes slow you down. Choose the right app from our curated list and watch as it supports the financial health of your business, one invoice at a time.